LEGACY PROGRAM

Helping Families Create Multi-Generational Wealth

WHAT IS TRUE LEGACY WEALTH? (TLW)

The True Legacy Wealth program, offered by Minuteman Taxpayer Advocates, Inc., provides an alternative to the traditional retirement system such as deferred comp or 457 plans. The program utilizes turnkey property investments to set you on a path to lasting financial reward and multi-generational wealth for your family.

We do not just aim to sell real estate, we help you create and operate a business that incorporates your entire family to ensure the knowledge, education and wealth that you acquire in your lifetime is passed from one generation to the next.

Our team of professionals will walk with you through the process, whether you are purchasing your first rental property or your hundredth.

We help families find the right rental property in stable markets and assist them in finding a lender when needed.

Then we provide customer service to support the management of your properties. As our investors build their portfolios, we provide support, education, and advice to help our investors treat their portfolios as a family-run business, to maximize tax benefits.

WHAT WE DO FOR OUR CLIENTS?

- Find, buy, finance and manage all in one.

- We bring property searches to you.

- All properties generate minimum of 10% cash flow after expenses and are between $75K – $150K.

- Properties are in sought-after stable rental markets throughout the country

- Assist you with a variety of financing options

- Tenants are interviewed and placed for you.

- Ongoing, on-call property maintenance and management

- Provide support, education and advice to family members of all ages to maximize the multi-generational wealth opportunity.

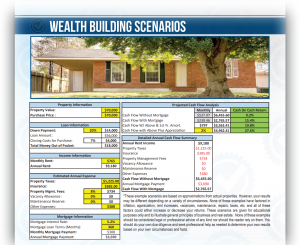

WEALTH BUILDING SCENARIOS

Jake contributes $20,000 into his retirement account every year while Anna purchases one rental property per

year using approximately $20,000 as a down payment.

At the end of 20 years, Anna owns 20 properties and receives $71,248.20 per year in rental income. When Anna

dies, her children may anticipate receiving $71,248.20 per year in rental income.

Note: This scenario does not include any adjustment for rent increases, which is expected to increase over

time. Also, Anna is building equity in the property due to appreciation, while her tenants pay down the loan

on the property.

Jake will not see any income from his retirement account until he reaches the age of retirement. Anna

receives the immediate benefit of a stream of rental income.

1031 Exchange Scenario

Kristina has a rental property in a market that does not cash flow as well as other markets do. This property is paid off and is worth $220,000. Kristina’s cash flow after expenses is $8,000 per year. Tax

laws allow her to exchange this property for other rental properties of equal or greater value without paying taxes on any profit she otherwise would have to pay if she sold the property outright.

Kristina does a 1031 exchange and is able to put $18,000 per property toward down payments and closing costs on 12 properties worth $70,000 each. Kristina’s cash flow is now $42,748.92 per year after

expenses and instead of owning one property worth $220,000 she owns 12 properties worth $840,000.

Remember, the tenants are making all the payments on these 12 properties and when all the loans are paid off Kristina will have $840,000 in equity instead of $220,000.

Inheritance Scenario

Mike inherits $2 million dollars from his mother. He is able to qualify for loans on four rentals with 20% down. He buys an additional 26 properties using the remaining cash. Results:

- Four properties down payment: $18,000 x 4= $72,000

- Twenty-six properties all cash with closing costs $74,000 x 26 = $1,924,000

- Total cash flow per year without vacancy and repairs: $182,095.24 (that’s $15,175 per month!)

- This amount will tend to increase over time with increases in rent. Also, equity will build up due to tenants paying off properties and appreciation.

Sale of Residence Scenario

Gabe sells his residence and receives cash of $400,000 from the sale. He uses $100,000 on a down payment on a new house and invests $300,000 in down payments on 14 rental properties. Gabe now receives $49,873.74 in annual cash flow from the rental properties.

Now, Gabe bought a $500,000 new residence with his down payment of $100,000. The annual mortgage payment on the new residence is $23,000 per year. His property taxes are $6,250. His insurance on his house is $2,200. His total for mortgage, insurance, and property taxes per year is $31,450 for his new residence.

This is $18,424 less than what Gabe receives as income from his rental properties. This means that Gabe lives in his new house which is all paid for by the rental income he gets. In addition the tenants are paying off his rental properties. Thus, Gabe is now building up equity in his new house and 14 rentals all paid by his tenants.

Furthermore, since Gabe has a larger mortgage on his residence than he would if he had used all of the $400,000 as a down payment, he will now have a much larger tax deduction on his personal tax return because of the higher amount of mortgage interest he can deduct. This is true even though he is not using any money from his paycheck to pay the mortgage on his residence because he is using the rental profits paid by his tenants to pay the mortgage on his residence.